💰 Women's football hits €158m – but is the "super club era" already here?

How Arsenal topped the women’s Money League, why commercial is now the growth engine, and what the widening “top three gap” means for the next phase of women’s football.

Introduction

The women’s game just crossed another threshold.

Deloitte’s latest women’s Football Money League headline is the kind that shifts the conversation:

Revenue across the top 15 clubs hit €158m in 2024/25 – up 35%, pushing average club revenue past €10m for the first time.

This isn’t just growth. It’s scale.

But Deloitte also flags a second trend that matters just as much: a meaningful gap is forming between the very top and the rest.

So the real question becomes:

Are we watching a rising tide – or the start of a two-speed women’s club economy?

Bottom Line Up Front

Arsenal are #1 for the first time – €25.6m, driven by elite matchday monetisation and stronger commercial performance.

Chelsea are right behind – €25.4m, and Deloitte say they generated the highest commercial revenue in the top 15 (€19.1m).

Commercial is now the engine – 72% of total revenue across the top 15.

The top is pulling away – the top three clubs alone generate 46% of the top-15 total.

WSL dominance continues – 8 of the top 15 are English clubs.

1) The leaderboard – the new top 15 (with revenue split)

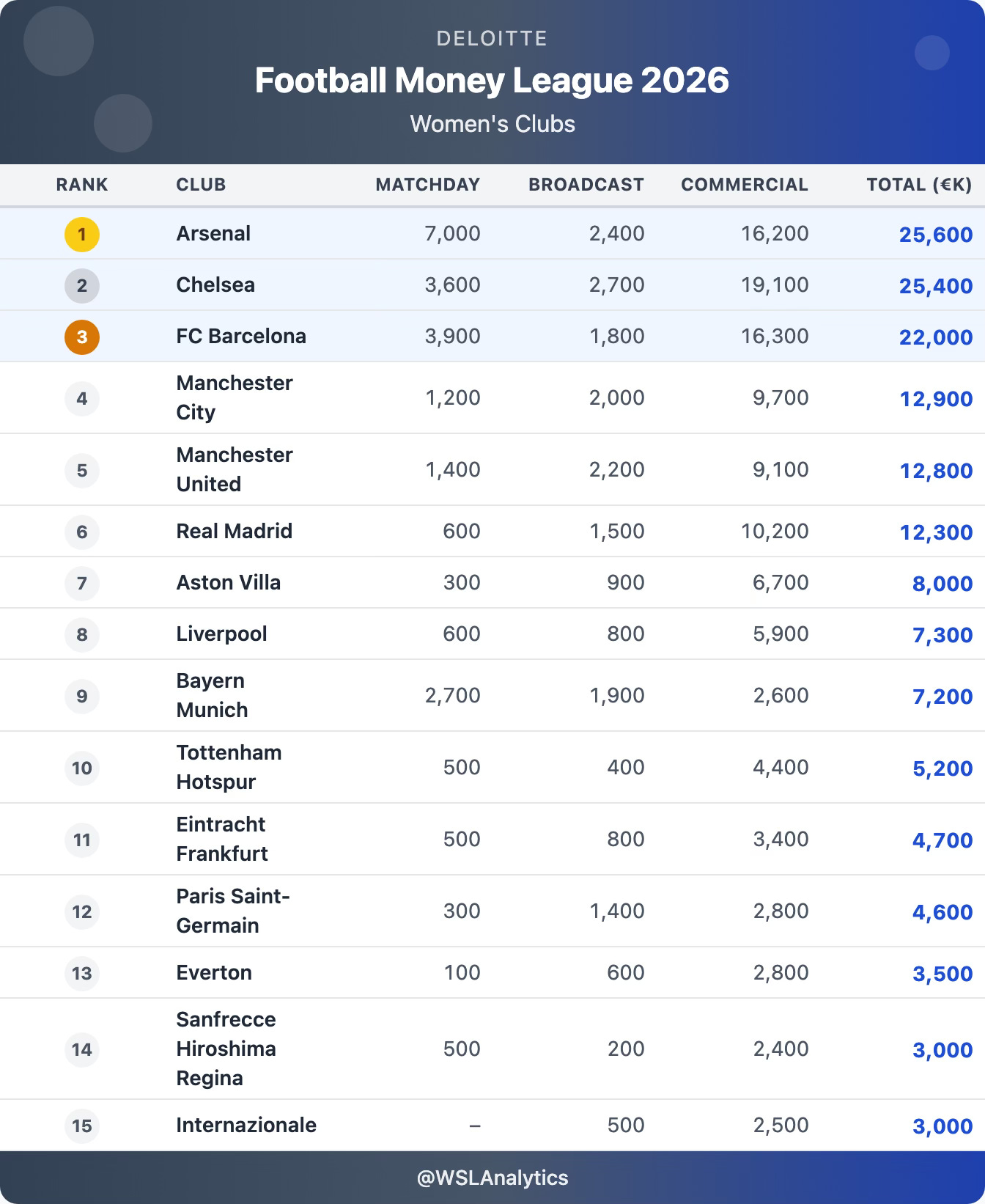

Deloitte’s table is valuable because it shows not only total revenue, but where it comes from – matchday, broadcast, and commercial.

All figures below are in €k (thousands of euros).

Immediate take – the WSL places 8 clubs in the top 15, including the top two (Arsenal and Chelsea). Commercial is the main driver at the top: Arsenal (€16.2m) and Chelsea (€19.1m) both generate far more commercially than via matchday and broadcast combined.

Source: Deloitte Football Money League 2026 (women’s clubs) – FY ending 2025. Table adapted by WSLAnalytics.

2) Arsenal at #1 – and why this is bigger than “big crowds”

Deloitte’s Arsenal notes are unusually specific:

€25.6m revenue – +43% year-on-year

attendances exceeding 35,000 on five occasions across 2024/25

tiered pricing to encourage repeat attendance

top-15 leading matchday revenue: €7.0m

The key point is this:

Arsenal aren’t just drawing crowds – they are turning crowds into repeatable revenue.

That distinction matters for the next phase of the women’s game. Many clubs can create one-off “event” crowds. Far fewer can turn matchday into a reliable business line.

3) Chelsea’s model – commercial supremacy

If Arsenal’s edge is matchday monetisation, Chelsea’s is commercial power.

Deloitte say:

Chelsea rank 2nd at €25.4m

they generated the highest commercial revenue in the top 15: €19.1m

This fits a pattern we see across women’s football right now:

The clubs with the strongest global brand infrastructure – sponsorship sales, partner activation, content machinery – can scale faster on the commercial side than clubs relying primarily on matchday growth.

4) The revenue mix tells you what women’s football is actually selling

Deloitte’s clearest league-wide line is also the most important:

Commercial revenue comprises 72% of the top 15’s total revenue.

They also note:

average matchday revenue rose 15% (from €1.3m to €1.5m)

broadcast revenue declined 6% to €1.3m on average, now 13% of total revenue

What does this reveal?

Women’s club football is currently being built as a commercial and brand-led product first – with broadcast still relatively small in the revenue mix.

That makes your content lane (audience, visibility, attention, culture, and monetisation strategy) even more relevant, because attention is increasingly being converted via sponsorship and partnerships – not just TV money.

5) The broadcast decline – cyclical or structural shift?

The 6% broadcast revenue decline deserves deeper analysis:

While Deloitte attributes this partly to “timing of leagues’ domestic rights cycles,” the trend reveals something more significant:

Women’s football is operating with a far lower reliance on broadcast than the men’s game. Broadcast now represents 13% of top-15 revenue, down 6% to €1.3m on average (and notably, it still rose 3% among the 13 repeat clubs, suggesting cycle timing effects rather than pure demand collapse).

Unlike men’s football where broadcast revenue is 38% of revenue on average (and 47% for clubs ranked 11–20), women’s clubs are building direct-to-fan and brand-partnership economies.

This isn’t necessarily bad – it means:

✅ Less dependence on media gatekeepers

✅ More control over fan experience and pricing

✅ Higher margins on commercial partnerships

⚠️ But requires sophisticated audience development

6) The top-three gap – the biggest strategic signal in the whole release

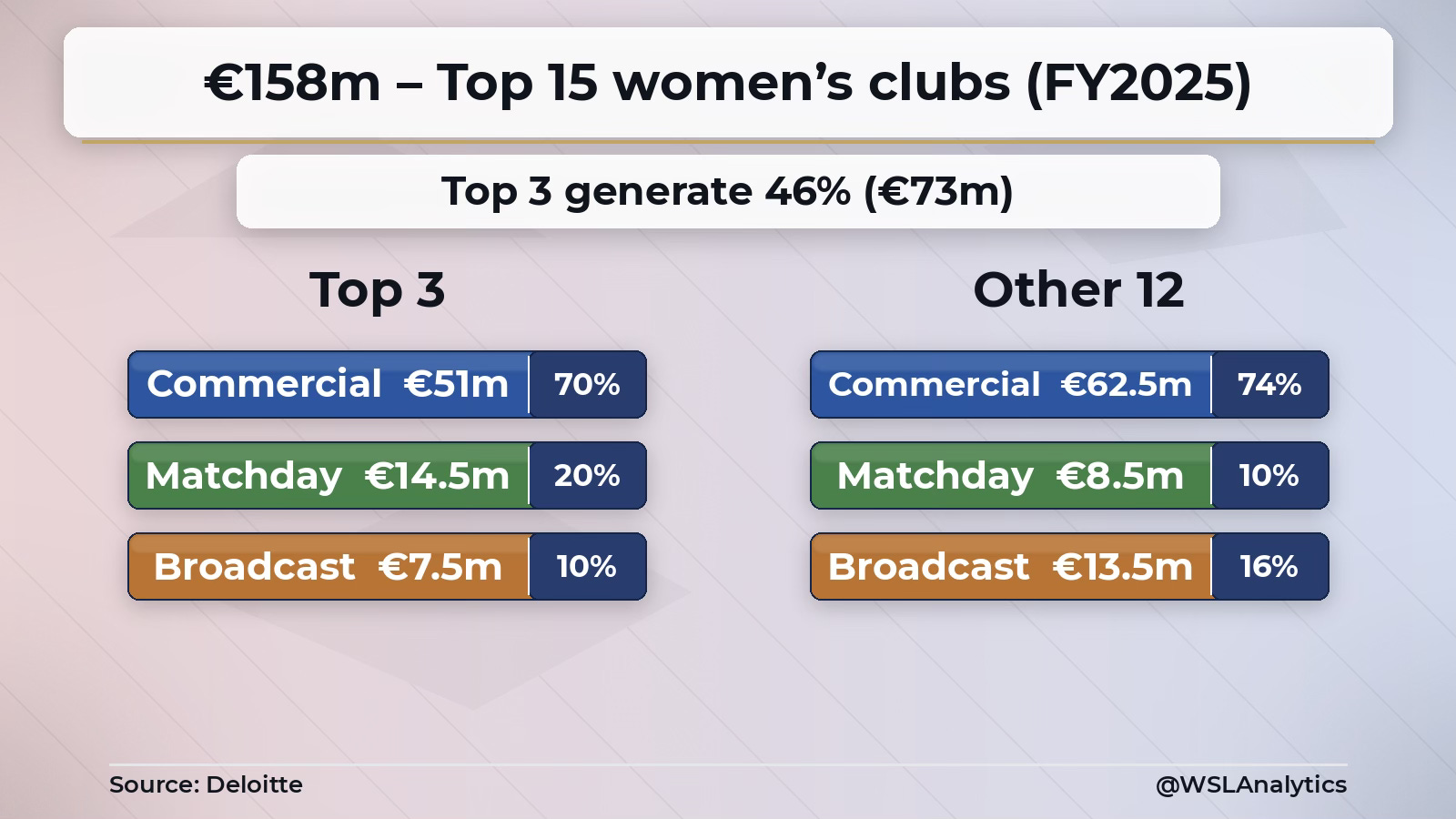

Deloitte state that the top three clubs generate 46% of the top-15 total.

They also quantify the gap:

Top three average revenue: €24.3m

The other 12 clubs average: €7.0m

That is not a small gap. That’s a structural separation.

It suggests women’s football is moving from a “rising together” phase into a phase where:

Elite clubs professionalise rapidly and reinvest heavily

Mid-tier clubs must find a distinctive growth path (venue strategy, local identity, player-led marketing, or competition-driven prize money)

7) Scale context – how this compares to men’s football

To understand the true significance of €158m:

Men’s top 20 clubs generate ~€11.2 billion annually

Women’s top 15 now generate €158m

That’s roughly 1.4% of men’s scale

But here’s the crucial insight: women’s football is growing at 35% annually while men’s football grows at 6%.

At current trajectories:

Women’s football could reach €500m+ by 2028

The revenue gap is closing faster than anyone predicted

8) Europe and innovation – revenue accelerants that can change club trajectories

Deloitte point to competition performance and new formats as meaningful revenue levers:

Manchester City (4th, €12.9m) grew 63% after returning to UWCL knockout stages for the first time since 2020/21

Bayern (8th, €7.2m) reportedly received €2.3m in prize money from the inaugural World Sevens Football tournament – “proportionately material” at this stage

This is important because it hints at a route for non-top-three clubs to jump tiers:

Strong European runs and emerging competition prize pools can meaningfully move the needle – especially when your baseline revenue is still in the single-digit millions.

9) The missing markets

Deloitte’s methodology excludes key markets:

Australia (Matildas effect)

Sweden (traditional powerhouse)

USA (NWSL growth)

This isn’t just a data gap – it’s a strategic blind spot.

The real global women’s football economy is meaningfully higher than €158m once you include the markets Deloitte could not capture due to unavailable revenue data. In other words: this is best read as the top 15 we can measure, not the full global leaderboard.

10) What this means for the next 24 months

Three scenarios are now possible:

Scenario A: “Super Club Era”

Top 3 clubs pull further ahead

Mid-tier clubs become feeder systems

Competitive balance suffers (the gap becomes extractive, not just large)

Scenario B: “Rising Floor”

New competitions and incremental prize money raise the baseline

Broadcast rights cycles improve

Gap narrows through structural changes (distribution, scheduling, commercial uplift)

Scenario C: “Two-Speed Economy”

Elite tier (€20m+ clubs) vs. professional tier (€5–15m clubs)

Different business models for different tiers

Both can be sustainable (elite global brands; domestic-first professional clubs)

Most likely outcome: Scenario C — because the current revenue distribution already looks two-tier: the top clubs are operating at a different commercial scale, while the rest are building more traditional professional models.

Method note – what Deloitte counts

Deloitte’s Money League reports club revenue from matchday, broadcast rights, and commercial sources (it is notvaluation and not profit).

Exchange rates used: €1 = GBP 0.84; €1 = USD 1.08; €1 = BRL 5.83; €1 = NOK 11.28; €1 = ¥162.64.

Sources: Deloitte Women’s Football Money League (top-15 women’s clubs) and Deloitte Football Money League (men’s comparator figures where referenced).

Key takeaways

€158m is a genuine milestone – the women’s club economy is scaling

WSL clubs continue to dominate the top 15, reinforcing England as the strongest monetisation market right now

Commercial is the growth engine – 72% of total revenue, which reshapes what “success” looks like off the pitch

Arsenal’s model is now the clearest matchday blueprint – data-driven audience strategy plus pricing plus scale

The top three gap is widening – and the next phase is about raising the floor, not just celebrating the ceiling

Final Thought

Is the women’s game heading towards a “super-club” era – or can league structures and new competitions help mid-tier clubs close the gap?

If you found this recap insightful, please consider subscribing and sharing, and join the conversation on X (Twitter) @WSLAnalytics for more WSL analysis throughout the season.